Here is a brief introduction to various financial assets, which can make you very curious about them and increase your awareness of the domestic as well as global economy system. However, there is still some complexity in the investment structure of some instruments, which you should be aware of if you are considering investing.

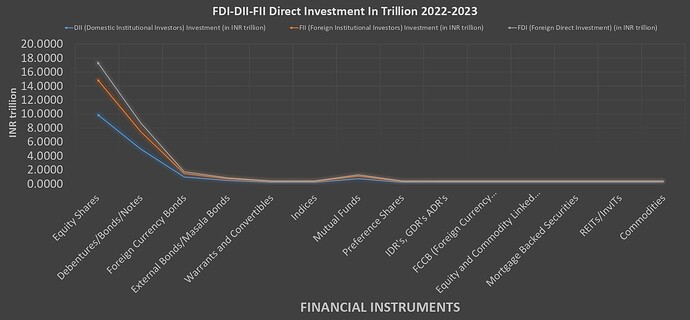

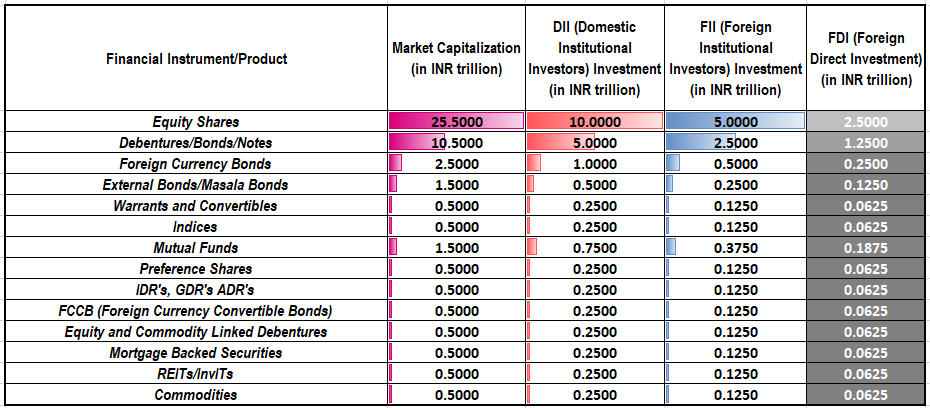

The below table above provides an overview of various financial instruments/products available in India, their market capitalization, and investment by domestic institutional investors (DIIs), foreign institutional investors (FIIs), and foreign direct investment (FDI) in FY2022-23.

- Market capitalization: The total market value of all the shares of a company that are outstanding.

- Domestic institutional investors (DIIs): Indian institutional investors such as mutual funds, insurance companies, and pension funds.

- Foreign institutional investors (FIIs): Foreign institutional investors such as hedge funds, mutual funds, and pension funds.

- Foreign direct investment (FDI): Investment made by a foreign company in a domestic company.

DII, FII, and FDI numbers are based on data from the National Securities Depository Limited (NSDL) for the fiscal year 2022-23 (April 2022 to March 2023).

Financial Instruments:

-

Equity Shares: Ownership units in firms, giving profits and voting rights. (Equity Shares)

- Indian Retailers: YES

- Pros: High returns, dividends.

- Cons: Volatile, riskier.

- Popularity: High, especially 2010s-2020s.

-

Debentures/Bonds/Notes: Debt for capital with fixed interest. (Debentures/Bonds/Notes)

- Indian Retailers: YES

- Pros: Stable income, safer.

- Cons: Fixed returns, default risk.

- Popularity: Consistent, rising in 2020s.

-

Foreign Currency Bonds: Bonds in non-home currencies. (Foreign Currency Bonds)

- Indian Retailers: YES (complex)

- Pros: Access to foreign capital.

- Cons: Currency risk.

- Popularity: Growing, especially in emerging markets.

-

External/Masala Bonds: Rupee bonds issued outside India. (Euro Bonds/Masala Bonds)

- Indian Retailers: YES (Masala Bonds)

- Pros: International capital access.

- Cons: Currency and regulatory risks.

- Popularity: Masala Bonds popular since 2014.

-

Warrants/Convertibles: Securities convertible to stock. (Warrants and Convertible Securities)

- Indian Retailers: YES

- Pros: High returns potential.

- Cons: Complexity, dilution risk.

- Popularity: High in tech, startups (2010s-2020s).

-

Indices (Stock Market Index): Measure of stock market changes.

- Indian Retailers: YES

- Pros: Market exposure.

- Cons: Not directly investable.

- Popularity: High, especially index funds (2010s-2020s).

-

Mutual Funds: Pooled investments in diverse assets. (Mutual Funds)

- Indian Retailers: YES

- Pros: Diversification, managed.

- Cons: Fees, potential underperformance.

- Popularity: Consistent, growth in ETFs recently.

-

Preference Shares: Equity with fixed dividends, asset claim. (Preference Shares)

- Indian Retailers: YES

- Pros: Stable dividends.

- Cons: Limited growth, usually no votes.

- Popularity: Consistent, industry-dependent.

-

Depository Receipts (IDR, GDR, ADR): Foreign securities in domestic banks. (Indian Depository Receipt, Global Depository Receipt, American Depository Receipt)

- Indian Retailers: YES (ADR/GDR complex)

- Pros: Access to foreign stocks.

- Cons: Currency risk, tax complexity.

- Popularity: ADRs consistent, others vary.

-

FCCBs (Foreign Currency Convertible Bonds): Convertible foreign currency bonds.

- Indian Retailers: YES (complex)

- Pros: Foreign capital, currency gains.

- Cons: Currency risk, dilution.

- Popularity: Popular in 2000s, fluctuating since.

- ELDs/CLDs (Equity and Commodity Linked Debentures): Debt with returns tied to assets.

- Indian Retailers: YES

- Pros: High returns potential.

- Cons: Higher risk, complex.

- Popularity: Growing interest (2010s-2020s).

- MBS (Mortgage Backed Securities): Securities backed by mortgage pools.

- Indian Retailers: YES (limited, complex)

- Pros: Income, housing market exposure.

- Cons: Credit risk, complexity.

- Popularity: Popular pre-2008, recovering slowly.

- REITs/InvITs (Real Estate/Infrastructure Investment Trusts): Trusts investing in real estate/infrastructure.

- Indian Retailers: YES

- Pros: Income, potential appreciation.

- Cons: Market risk, liquidity issues.

- Popularity: Rising, especially in Asia (2010s).

- Commodities: Tradeable basic goods. (Commodities)

- Indian Retailers: YES

- Pros: Diversification, returns potential.

- Cons: Volatile, specialized knowledge needed.

- Popularity: Consistent, increased accessibility (2000s-2010s).

I hope this is helpful![poll type=number results=on_vote min=0 max=5 step=1 close=2023-10-27T18:30:00.000Z]

I hope this is helpful!

[/poll]